Share

Read Next

Additive manufacturing is a dynamic space for various reasons: The technology is advancing and application possibilities are still being developed, and as a direct consequence, the landscape of AM companies is subject to change due to investor moves; mergers and acquisitions; and startups emerging from “stealth mode.” In our reporting for Additive Manufacturing Media, we serve manufacturers by covering AM technology and applications — the corporate and financial moves are not our focus. And yet, one realm affects the other. The company moves shape what we cover and affect the choices manufacturers make as they aim to proceed with the technology. In this episode of AM Radio, I talk about this with Stephanie Hendrixson. We discuss how the corporate and financial developments among AM companies play out for AM users, and where the dynamism of the additive space is likely to lead in the future. Listen to the episode above, find it on any podcast app, or read the transcript below.

Transcript

Peter Zelinski 00:05

Additive manufacturing is also dynamic manufacturing. The technology is changing, the companies are changing. What does all this mean for additive progress and for additive winning acceptance? That's coming up on AM Radio.

Jodee McElfresh 00:26

This episode of AM Radio is brought to you by Formnext forum Austin, the first of a series of Formnext events coming to the United States, find more information at Formnextforum.com.

Peter Zelinski 00:41

Welcome to AM Radio, the podcast where we tune in to what's happening in additive manufacturing. I'm Pete Zelinski Additive Manufacturing Media. And I'm joined by my colleague Stephanie Hendrixson

Stephanie Hendrixson

Hi Pete.

Peter Zelinski

Hello. So, a couple of weeks ago, something big happened in the additive manufacturing space related to two companies Stratasys and Desktop Metal.

Stephanie Hendrixson 01:04

Yeah, well, the announcement of something that is allegedly going to happen. So Desktop Metal and Stratasys announced their intention to merge, which if that happened, I believe it would take place later this year. Within a couple of days, 3D Systems kind of came out of the woodwork with this other offer to Stratasys. And I think we're still kind of like waiting to figure out how all of this is going to play out. But if that merger does happen, that would be a really big deal for this industry. So Desktop Metal has been acquiring companies left and right, it feels like for the last year or so and so for them to then team up with Stratasys, which is a long standing kind of stable player in additive and has also been acquiring it has also been acquiring that would bring a lot of different types of technology together under one company potentially.

Peter Zelinski 01:45

So I bring it up, because I think there's a good conversation we could have not about that specifically, but sort of a conversation around that. And the fact that the additive manufacturing space is different from other part production, manufacturing technology spaces, because of this kind of dynamism, the financial moves, the company changes the merger and acquisition activity, all of it. It affects the way that we do our work. So top level, most basic example of that we're approached all the time by companies I'm really excited about we just made this VC funding target. Do you want to report on this? Do you want to, do you want to interview our leadership? And our answer is generally no to that because it's not our lane. It's not we cut what we cover, even though it's an important part of this space. So I'd like to kind of explore that a little bit. The ways that that particular aspect of the dynamism of this space affects what we tried to do.

Stephanie Hendrixson 02:43

Yeah, and we should say like, if you really are interested in the investments in the seed funding, all that stuff, like there are other outlets for that. It's just not what we cover as our core content. We're talking mostly to people who are using additive, people who are manufacturers thinking about adopting additive, like that's more our focus, and we stick more to technology and applications.

Peter Zelinski 03:03

And I think it's important for a moment to say why that is, who we are where we come from. So our employer, Gardner Business Media, it is a media company that has always been focused just on discrete part production, the companies buying production capital equipment, it's been the case almost for a century publication called Modern Machine Shop is how the company founded all about CNC machine tools. And so that has never changed. And it informs the ways Stephanie, you and I and our team on Additive Manufacturing Media, who we speak to and what we're reporting. Our audience is leaders of manufacturing businesses, leaders of manufacturing facilities, and we're talking to them about the manufacturing technology choices they're making. I think we do reach investors, we see that all the time. They're sort of curious about our take on things. But it's not the audience we're really aiming for.

Stephanie Hendrixson 04:00

Yeah, that's true. But it's also true that you do describe the additive manufacturing as being this like dynamic space. And that dynamism really affects the job that we do, because we've got to keep up with all of the mergers and acquisitions of which there have been many. So just a few in the last few years that I was thinking of in preparation for this episode Ultimaker and MakerBot joining together to become UltiMaker, capital M. Markforged acquiring Digital Metal. Linear, which is more of a service provider becoming part of Shapeways, which is a bigger service provider in the sense. Nexa3D acquiring AddiFab. Like these are all things that in our reporting, we've got to keep in mind, like who owns who and what types of moves have been made, just so we can keep it straight in the in the articles that we write in the coverage that we provide.

Peter Zelinski 04:45

Right. So that's right, so all those company moves you just listed I remember all of that. And you're right, that's all very recent, and it paints a picture of the kind of change that is inherent to this space, and it's not what we aim to cover. It's not the center of our target. But it certainly affects and shapes what we cover. It affects our sense of the companies that we're reporting on. But also, we're speaking to an audience that sees all of that happening. And it affects the choices, the current and prospective users of additive technology, it affects the choices that they are setting out to make. So all of this is important. And it plays into the way we cover manufacturing processes and manufacturing successes, what comes to your mind?

Stephanie Hendrixson 05:28

Well, I mean, like, there's this whole phenomenon of companies coming out of stealth mode, which is like the terminologies startups use when they finally go public with the thing that they've been working on for sometimes, like five or six years previously. And it's not unusual for us to open our email inbox on like a Monday morning and get introduced to this company that we've never heard of that's doing something really interesting with a new type of 3D printing hardware or material or something like that. And we just always have to be prepared to be introduced to something that we did not know existed 24 hours prior

Peter Zelinski 06:01

Velo3D is an example of that, I can remember the moment when I had never heard of Velo3D before, but they came out of stealth mode. And that was relatively recently.

Stephanie Hendrixson 06:11

It also creates like some challenges in reporting on some of these companies, I guess, when I'm going into a story and knowing that it's like a venture backed type of business, I'm expecting they're going to be a little bit less open, they're gonna be a little bit more closed off. If I'm physically going to be there, I'm kind of prepared for okay, no photos, no, no video on site. I don't know exactly what creates that expectation. But I feel like it happens more so with companies that are thinking about their, their investors and that kind of thing. I've also had the experience that the language is a little bit different. Sometimes I had a recent story about a company that I won't name, but they are a venture backed additive manufacturing company. And when I wrote about them, it was the first time they'd been covered in the trade press, they've got some other coverage and more like mainstream media. And the story that was being told in those other outlets I felt was really targeted kind of towards that investor audience and, and also trying to explain what they do to a more general public. And that created a little bit of friction, we had some back and forth over some terminology that I wanted to use, because I thought it was clear for the audience we serve that is in additive manufacturing, that is thinking about this technology. And they had some pushback, because it's not the way that they've been portrayed previously. And I also think like it has a little bit to do with the language that they've used to talk to investors. So we had to kind of just negotiate that out. And there have been some some things like that, that affect the way that we report on these types of companies.

Peter Zelinski 07:32

And you're pointing to that the investor audience is one constituency with a certain language and perspective. And the manufacturers, the ultimate users of the technology are a different audience with a different perspective. Recognizing that I think it's important to say is not to disparage the investor audience that is different than the one we're aiming to speak to. There is a lot of important value and power that comes out of the investor interest in additive manufacturing. It's among other things, it is an accelerant. It allows positive things to happen way faster than they could organically happen if it was just a company's own profit and investment that was allowing them to advance and build their own technology. I guess a clear moment of this came out of a recent conversation with Greg Morris, this is a well known name and additive manufacturing. He's one of the pioneers with part production in additive manufacturing. And he's part of a relatively new business now. Zeda is the merger of a company that he co-founded. Vertex and PrinterPrezz and they are aiming to be a large scale manufacturer through additive manufacturing serving various industries. And we just reported on a big plant that they are building soon to open this year in the Cincinnati area. Well, so Greg Morris comes from a family that generationally has been in manufacturing as an and is accustomed to succeeding in manufacturing in sort of a family business mode of proceeding. PrinterPrezz, literally founded in Silicon Valley, is also a manufacturing service provider, but much more adept at the the venture capital type community and pursuing funding that way and I'm walking through this facility under construction with Greg Morris and he's commenting on that the investor support for what they're doing and he's pointing to the size of it and the equipment they're bringing in and he says there's just no other way that we would be able to do this scale up this fast in the absence of the investor support like in the absence of this, what else am I going to do? He asks, it's like I get a machine succeed with that, build up some profit margin off of that then invest in the next machine. And it could take years decades to accomplish what the company will be able to accomplish much faster, thanks to investors seeking returns on this business.

Stephanie Hendrixson 10:25

That's such a good point. And the way that technology moves and advances in additive, like, it makes a lot of sense to go after that kind of investment capital, because you're going to be able to make gains so much more quickly, you're going to be able to buy the equipment that you need right now. And yeah, not have to sort of piecemeal build up the business in a more traditional way.

Peter Zelinski 10:45

It's an accelerant. But when you bring that accelerant to discrete part production, it plays out in a particular way. I think you and I have both seen. And I want to talk this out and talk around it a little bit. Discrete part manufacturing, is always it seems to me almost always inherently done on not quite the most current technology. By its very nature. It you know, to use, like an iPhone analogy, if the world is on iPhone 14, then the largest share of discrete part production is being done on iPhone 8s. And it's always happening that way. And it's always like that, and there are reasons for that. It has to do with the tremendous value in finding a platform that works and sticking to that, alongside the cost and difficulty of changing a platform that's working, I think, have you seen this phenomenon?

Stephanie Hendrixson 11:53

Yeah, like you're sort of putting words to this thing, this disconnect that I've been aware of, but maybe haven't really articulated in the past, like on the one hand, we as writers and journalists covering this space, who have to be aware of the the cutting edge, new things, the companies that are coming out of stealth mode. But it takes a while for that technology to get adopted by the types of businesses that you're describing, that are producing discrete parts with with these things. And so as a result, like when you walk into a manufacturing facility, it's more of a case of you're going to see an established technology that has been around for a while that has kind of a network of support. And then everything that you're saying about like the difficulty with changing, we see all the time companies that make this investment in additive, and they want to do scale production, and they want to go into ongoing serial manufacturing. And the way to scale up is get the printer that does the work you need it to do and then buy exactly the same printer.

Peter Zelinski 12:46

Right, right. We need to talk about this in this context, because the investor activity inherently is taking place at the leading edge and has to do with advancing the leading edge. And manufacturing is done not at the leading edge, but on platforms that are working and even platforms that are allowed to get a little dated because they keep on working. And it's not even just a difference between, say conventional manufacturing versus additive manufacturing. It plays out within additive manufacturing as well. I think I've heard you make this observation about what we used to call Tangible Solutions. I guess it's now Marle Tangible.

Stephanie Hendrixson 13:25

Yeah. So when we first started reporting on them, when they established their their facility up near Dayton, Ohio, they bought Concept Laser machines, and it was Concept Laser at the time, I believe.

Peter Zelinski

Yes.

Stephanie Hendrixson

And as they've grown, they have just continued to continue to buy concept Laser, now GE Additive Concept Laser, laser powder bed fusion machines, and they have I think they're up to like 10 or so total.

Peter Zelinksi

Same model?

Stephanie Hendrixson

Yeah, same model, I think they have one or two that are the larger footprint, but most of them are the exact same concept laser, I think it's the M2 size, and they make spine implants. So like they are beholden to the FDA. And for them, the easiest way to scale is go through the FDA certification process on the products that they're making. And then it's much easier to kind of re-qualify on different machines that are the same model using the exact same process.

Peter Zelinski 14:18

We've been covering them for a long time. And they're one of many manufacturers we have just kind of stayed in touch with and and I can remember the time the tangible owners, when they were going through the process of understanding these machines and kind of like proving out the process and understanding for example, how the laser behaves in different areas of the build plate in different areas of the build area and just working all that out, validating all of that. Once you've got all of that sticking with a platform is not a matter of being resistant to technology advance the companies like them are watching the technology advance. But sticking to a platform is a matter of printing money. It's like we've got the investment made, we know what we're doing. Now let's just scale up and profit more off of this platform that we've worked out.

Stephanie Hendrixson 15:09

Yeah, the, I guess the flip side of that is if they woke up tomorrow and decided they wanted to go in a different direction, like the more of these identical printers that you have in your production floor, like that becomes much more difficult to totally change platforms to change processes, even to go with a different vendor for a similar type of technology.

Peter Zelinski 15:27

Right, right. So a pretty amazing example of this, that that comes to my mind, Cleveland area, the business, RP+M company that was created by Thogus, a successful injection molder in that area. And this is a company that does production, 3D printing in polymer. And a company particularly notable to us, they just happen to be the very first company we covered in our very first cover story of what would go on to become additive manufacturing magazine. And at that time, at the very beginning, they were starting to experiment and get good with Stratasys, Fortus machines, fused deposition, modeling, 3D printing in polymer. And as that business progressed, they also tried all of these different 3D printing augments to what they're able to do. And they were into binder jet. And I believe they had investigated and tried laser powder, bed fusion, various different avenues, none of which proved to be as successful or promising for them as that original FDM investment. And ultimately, they figured out how to advance the capabilities and the technology on this machine. They worked out a process for reliable, repeatable production, 3D printing in alterum. But then they streamline the company and focus the company on to emphasizing that aspect of the business. So the actual 3D printing platform has been the same for a decade. But they've spent those years getting really good at that platform.

Stephanie Hendrixson 17:17

Yeah, and like now, they're at a point where they're making aerospace parts and number of their machines are qualified for that. And it's like, lock them down, do not change anything about that. You could take that to the extreme with something like a company like slant 3D out in Idaho, they build their own printers, they're FDM machines, they're like desktop sized, but they have hundreds of these identical printers. And like, that's the way that they get to scale with FDM. 3D printing is just keep putting the same exact printers into the facility. And like that increases the number of parts you can make. And they've developed this machine themselves. And they feel like it is, you know, kind of locked in at this point. And they're not going to go out and buy a printer off the shelf. They're not going to change the model, because they're at a place where they can deliver production quantities. And there's not a lot of impetus to make a change at that point.

Peter Zelinski 18:09

We're talking about all this because all of that dynamism, corporate dynamism in this space that results from the investor activity, the merger and acquisition activity. All of that is playing out against the backdrop of this set of users and adopters that inherently needs and wants platform consistency.

Stephanie Hendrixson 18:36

Yeah, I mean, like even thinking of some of the facilities that we've been to where it's not fully built out yet. And there's like open floor space, often there is this expectation that that open space is going to be filled with more of the same printer that's already there. So I'm thinking of like GKN Additive, and their new facility in Michigan, we got to visit kind of before everything was fully moved in. They had a handful of different printers, a couple of different technologies there. But I'm thinking specifically of the room with the two Multi Jet Fusion printers. So they had two printers that were up and running that were making these polymer parts, and our host Ken Burns said this room is actually built to accommodate 18 more of these machines. That's how they're thinking of scale is we're going to bring in more printers as we need them. We're going to build out this whole room and it's all going to be this exact same technology.

Peter Zelinski 19:23

Yeah, the wide open floor space facilities. We've seen many examples of this. And that's where you tend to see the very latest 3D printing technology beginning to be adopted, I guess what comes to my mind one example Wabtec, their facility in Pittsburgh and Neighborhood 91. This company manufactures braking systems for locomotives, and they're making parts in this in this Pittsburgh facility that's using this advanced SLM Solutions machine big laser powder bed fusion machine, high productivity machine, and plenty of floor space to fill them the facility with more as they go forward with this. Another like really big open floor space facility is Collins Aerospace in the Charlotte, North Carolina area, a company that again, has has opened a new additive manufacturing production facility has a couple of machines and fully expects to fill the facility with more as production advances. And the thing by bringing this up, the thing that you're making me realize about these facilities is they start out cutting edge when they're wide open. And then they're going to keep adding machines to advance and expand the same platform. That very facility will be retro by the time all the floor space is filled by virtue of the fact that they're going to want to stick with a platform that works.

Stephanie Hendrixson 21:03

Yeah, so the cutting edge platform that just kind of gets replicated across the floor, like you end up with what looks like more of a factory like something that is established, making parts day in and day out.

21:16

Yeah, so manufacturers part producers adopting additive, advancing with additive, they are setting out on this long arc. And they expect to build up significant production capacity. And they believe they're looking for their equipment suppliers, to be on that journey with them and to be on that arc with them. And the thing is, they will get to have this like ultimately, the companies who can follow along on that arc are the ones that are going to sustain and thrive in this space. And that is going to affect how the additive manufacturing space is shaped and how it behaves like I think we can look into the years to come and expect that to happen. Maybe we talk about that after the break. Sounds good.

Jodee McElfresh 22:15

This episode of a AM Radio is brought to you by Formnext Forum Austin, a new Formnext event coming to the US this summer. The Conference and Expo is organized by Mesago Messe Frankfurt,

AMT—The Association For Manufacturing Technology, and Gardner Business Media, the publisher of Additive Manufacturing Media. Formnext Forum Austin is designed for leaders and owners of manufacturing enterprises, including companies already advancing with additive in those getting ready to adopt it. It's also for engineers engaging with additive technology and researchers who are advancing what is possible for AM to do. The conference program offers three tracks: Production powered by The Cool Parts Show; Design For Additive Manufacturing powered by CIMP-3D; and Technology powered by Additive Manufacturing Media. The event also includes an expo featuring AM technology, tours of local additive manufacturers and plenty of networking opportunities. And don't miss the finalists of The Cool Part Showcase, a contest highlighting innovative 3D printed parts. Join Additive Manufacturing Media for Formnext forum, August 28. Through the 30th and Austin, Texas. Find more information about exhibiting attending or sponsoring this event at FormnextForum.com.

Peter Zelinski 23:36

Welcome back. So Stephanie, before the break, we were talking about this long arc that part producers manufacturers are on with the technology they use for production and sort of the contrast in that with the froth and churn and dynamism at the leading edge of the technology, where a lot of the investment activity is concentrated. I guess I saw an interesting juxtaposition of that. When I was in Oregon recently, I stopped by HP’s facility in Corvallis, Oregon. And they've been there a long time. And they have been developing technology. They're sometimes leading-edge technology there a long time I took a bunch of photos of they have sort of this museum area of formerly new technologies that they have developed in this facility like I saw the the first laptop, I shared some of those pictures with you.

Stephanie Hendrixson 24:42

Yeah, so the laptop is actually my favorite in this collection of photos. It is very 1985. It's very boxy. Just a lot of light gray and white plastic. The other interesting thing in this collection of photos there's a lot of or there's at least a couple of iterations of inkjet So 2D printing. And what I've gathered from kind of past reporting on HP and from what we've talked about their 2D printing experience still continues to inform what they're doing with 3D printers.

Peter Zelinski 25:13

Right. And so we will share a link to all these photos in the show description. Yeah, HP was actually developing 3D printing technology before they knew that that's what they were doing. And I'll, I'll circle back to that. But this whole museum area that they have on display there, it makes an important point or a point that that HP feels is valuable to make. They've been in this Corvallis location for decades for 30 years or something. And HP now and additive manufacturing technology company, Multi Jet Fusion is a successful platform. And HP has now recently fully gone to market with its metal binder, jetting system and new technologies. But it is valuable and important for HP to make the point that we're going to be here and we're going to ride out these technologies as they continue to advance. And we're going to continue to support them the way that we have been here for all of these other now very old and dated looking technologies that that they have on display. I mentioned, they were doing 3D printing technology before they knew they were doing it. So when I was visiting, my host was Tim Weber. He's HP’s head of metal 3D printing R&D. He pointed out that the company has spent decades developing latex inks for outdoor signage. So inks that are able to stand up to water, whether air light latex inks that are durable and resilient that way, it turns out, and in part, this is just luck. But it turns out, those inks also stick to metal really well. And so that technology has proven to be the basis for HP’s binder in their own binder jetting which you have a stickier ink for holding metal together. And what it lets you do is stronger and more reliable parts at bigger dimensional volumes. So HP is having success, some success with their platform. And some some early cut customers that are talking to that have needs for binder jet have some particularly large parts. And this is working out. So there is this legacy of technology development at this facility and a legacy that in some ways takes lessons from one type of product and finds usefulness in an entirely different type of product. But HP takes a lot of care and gives a some building footprint to emphasizing this, because they've come to recognize that it's valuable for potential users to see that legacy see that history and infer from that, that the legacy will continue into the future.

Stephanie Hendrixson 28:15

Yeah, like the the museum is not so much about the literal steps on the timeline, as it is showing that there is this timeline.

Peter Zelinski

Exactly, yes.

Stephanie Hendrixson

Which is sort of a weird juxtaposition in the additive manufacturing space where a lot of the hardware companies, even the the software and the materials are sometimes pretty young. HP has this like decades long history, but there's not so much like that same expectation when you're dealing with like a newer 3D printing technology that that there's going to be this long history to point to.

Peter Zelinski 28:44

Right, right. So how do they deal with that?

Stephanie Hendrixson 28:47

Yeah, so like, you have to find ways of establishing that sort of stability and signaling longevity before you have the literal museum timeline to show for it, right. So where my mind goes first as an example of a company that has kind of figured this out, and it's because we visited kind of recently, but Fortify. So they are a venture-funded startup, they developed this DLP platform, along with this Continuous Kinetic Mixing technology. And basically what it lets them do is to print with really viscous resins, to print with resins that have different fillers in them. So you can put like, glass flake or carbon fiber or like different additives into the residence. In one iteration of this platform, you can even control the directionality of the stuff that you put in there. I've got this sample part at home that's like a clear resin, but then it's got these metal flakes in it that like make their logo so like you can get some really precise control. You could do really interesting things with this platform. But from pretty early on, Fortify has kind of made it known that they are they want to offer this for injection molding. So with their materials and this printer, you can make injection molded tooling. It's polymer, but it's sort of like a polymer composite. And it's kind of an option before you get to the metal, hard tooling, like if you're not quite ready to commit to having that tool manufactured, or you're waiting for the tool to be delivered, or maybe you just only need a couple 100, or something like this could be a way to make that tooling. And so when we were visiting back in March, I learned something that I didn't know previously. And that is that Fortify, because they had that application in mind, they actually built out like a whole team of injection molding experts to serve customers that want to use the technology in that way. And it's like, even to the point where you're touring the facility, and on one wall, there's a row of their 3D printers. And on the opposite wall, there's an injection molding press, like they're, they're testing these tools in house, and they're really, really committed to it. And then they're now on this same similar journey with radio frequency devices. They're bringing in they're, they're hiring people that know that space, and figuring out how to apply this technology as a solution that's going to be useful for these types of devices. That's one way I think of kind of signaling stability, like showing that you are putting the investment behind these specific applications, so that people in those spaces come to trust this as a solution and believe that is going to be there to support them over the long term

Peter Zelinski 31:15

That came out in your article about Fortify, which we'll link to, which is, it's almost the case that Fortify doesn't even see itself or characterize itself as a 3D printing technology company. But instead, they are a company bringing special solutions first to mold tooling. And now to radiofrequency hardware, it happens to leverage 3D printing. But as you say, they're signaling potential stability within a market by showing the development of expertise tailored to that particular market, it's like, this particular application has to succeed, because you can see we're betting our resources on this application as well.

Stephanie Hendrixson 32:01

Yeah. And another part of this as well, is partnerships. Like, I think that's another way to kind of signal that in the case of fortify like they're working really closely with Rogers Corporation, which manufactures materials for those radiofrequency type of applications. And so that's another way of saying like, we are committed to this space, we're going to serve it and we're working with the existing companies that are already here, too.

Peter Zelinski 32:23

So it's like the next step, in addition to technology advance, it is also directing energy toward what this technology can do,

Stephanie Hendrixson 32:33

Tight. And like that's on the application side of things, kind of on, like the marketing side of things. But there are some ways that this plays out with technology, too. So I'm thinking of like Evolve Additive Solutions. They have a polymer 3D printing platform. It's called Selective Thermoplastic, Electrophotographic Process or STEP. And kind of similar to HP, it is using 2D printing technology to print layers of parts and build up polymer parts very quickly. This is another case where we've been aware of the technology for a while. And I think just recently, the first one of these platforms was installed at Fathom manufacturing. But this is a much younger company than HP but they're sort of benefiting from that same sort of like we're using this established process. We're just adapting it for additive manufacturing. And like, that's another way I think of kind of signaling stability, like this is something that played out very well in 2D printing. And so we're gonna trust it for 3D printing, and we're gonna be here to support it that way.

Peter Zelinski 33:30

Right? The point you're making is, we're, we're a young company, we don't have a legacy. But you don't have to just trust us because the technology is proven. And the technology we've chosen to use and expand upon does have a legacy.

Stephanie Hendrixson 33:45

Yes. But that's not to say that like very new and innovative things can't get sort of established into this as well. I mean, so a company that we visited way back in 2019, was Origin out in California, and like very startup culture, they were this very young company, they were just at the point of starting to ship out their DLP printers, like they hadn't even got to that step yet. 2020 happens and Origin ends up partnering with Stratasys on making COVID swabs. And then Stratasys acquired them at the end of the year. So it's like, this is a company that had a very short history, they had a very innovative platform, and the legitimacy is now coming through acquisition, like we've been talking about.

Peter Zelinski 34:26

Yeah. And you said, you said legitimacy, they had legitimacy in the sense that their technology is very promising and working very well.

Stephanie Hendrixson

Absolutely. Yeah.

Peter Zelinski

But Stratasys the acquiring company had the longer history. And so Origin coming in and joining that organization kind of got grafted on to that history. Yeah. Let me circle back to something you mentioned earlier, you were talking about fortify, they're investing in particular promising applications. So someone we know who does cover the investment side of additive Dayton Horvath, he's with AMT—The Association For Manufacturing Technology. He writes work that sometimes appears on AdditiveManufacturing.Media. He comes to mind in this context, because he wrote a piece recently that identified something similar to what you're picking up on Stephanie, about a shift in venture capital investment aims in additive manufacturing, the volume of investor activity continues to increase. And he documents that. But he noted in a piece that will link to how a much larger percentage of the investment is going to specifically application focused like as opposed to investing in companies, making machines making new 3D printing technology for anybody to use the share of investment that's going specifically to targeted end use applications in dental say, more than tripled from 2021 to 2022.

Stephanie Hendrixson 36:09

Yeah, I thought this was really interesting, I wasn't really aware of that have the breakdown of investment and kind of that shift happening. But in preparation for this episode, I've spent a few minutes on CrunchBase just kind of like searching around trying to figure out what I could find about investments in 3D printing. And according to that database, like there are some companies that definitely fit that model, that application focus that received capital funding in like the last year or so some of them are a little bit outside of our space. So one is called Axial 3D, which makes anatomical models for healthcare, which is not something we really report on that much. Another is called Redefine Meat, which is a 3D printed meat alternative. But then there are some some companies that we would recognize and that we have reported on. So for instance, Hilos, they make 3D printed footwear, it's customized to your foot, they're made on demand. Icon, the 3D printing, construction company. Divergent, which is becoming known as an automotive manufacturer, but they're also serving defense and aero and some other different industries. And another one that I found was Zeda, which we talked about at the top of the show.

Peter Zelinski 37:14

Oh, so that investment emphasis strikes me as the right next step, healthy, encouraging, like, so 3D printing on its own was never the thing, additive manufacturing is valuable, because of the new possibilities that it brings the new things it makes possible. And we're seeing additive succeed. In all of these different pockets spread across different industries. Sometimes the pockets disconnected from each other, like meat and construction. And medical implants don't necessarily connect, but they're all circles that are growing with additive manufacturing. So now that those localized successes are starting to grow and flourish, those fruitful applications of additive are the logical place for the investment to start flowing.

Stephanie Hendrixson 38:08

Yeah. And so as that switch happens, like, what is going to change with additive manufacturing, like how is the space gonna look different in the future? Do you think?

Peter Zelinski 38:17

So? I've got some thoughts, I think, actually, we can predict the answer to that with some confidence, because there are established manufacturing technology spaces, manufacturing capital equipment spaces that behave in a certain way. And as additive becomes fully established, it's going to look more like those spaces. So I think the changes coming in the coming years what that looks like, I'll name three. So one is from over promising to under promising and maybe over promising isn't quite the right word. But if a company is in the mode of seeking investor support, then they're incentivized to tell the most positive possible story of what they're apt to be able to do with that money. In other words, like the outcome is going to be some combination of the quality of the idea and the ability of the company and luck. So yeah, so what is the story you can tell? If you assume good luck is going to be with you? How far could this really go? Conversely, if you're speaking to manufacturers and making promises to them, the incentive is to under promise, let's assume that bad luck is going to happen. And we're going to have to deliver anyway. So that is a shift a pretty fundamental one in the way the company communicates about what it's doing.

Stephanie Hendrixson 39:45

Yeah, the audience changes. And so the messaging has to change to as well as the way that you think about delivering on what you're promising.

Peter Zelinski 39:54

Yeah, so another one, a shift from innovation to of service. So, at the beginning, and particularly when you're still in stealth mode, you are innovating, innovating, innovating, you are pushing this technology forward, you are pushing the limits of all that you think it might be able to do. But then there comes a later point where that technology is out there. And the vital question for prospective users isn't as much, what are the limits of what it can do? As far as how confident Am I that this is going to keep running? Or that you technology provider are going to take care of me if there is a glitch along the way?

Stephanie Hendrixson 40:39

Yeah. And then you start to worry about things like consumables, and are you going to have build plates? Are you going to have recoated blades, like stuff like that becomes more of a consideration

Peter Zelinski 40:48

Exactly. And here's one more shift, we're apt to see in the years to come. For additive technology providers, a shift from dynamism, say, to stability, and constancy. That means that does not mean by any extent that the technology innovation stops. But when a manufacturing technology company succeeds, they succeed by getting lots of users, lots of customers, and there comes a point where your best source of potential new business is all of these existing customers and users out there. And so a shift to being a steady force for all of those existing users turns into the lucrative way to proceed.

Stephanie Hendrixson 41:35

Yeah, I think additive manufacturing still has some innovation left. I think we're still going to be encountering those companies coming out of stealth mode for a while. And I hope that that's true. But I think you're right, that we will get to a more established place a lot of the companies that seem kind of new and innovative and a little bit crazy right now, like we'll get to that more established place of service.

Peter Zelinski 41:59

Isn't that the fascinating thing, some of these companies that are brand new right now are the established legacy companies of the future, and we don't necessarily know which ones those are, I look forward to finding out. Alright, thanks for listening to AM Radio. If you like the show, tell a friend about us. Subscribe, get them to subscribe. And yeah, if you could both give us a five-star rating, it really helps us.

Stephanie Hendrixson 42:22

We're gonna put links to the things that we talked about in the shownotes today. And if you want more content on additive manufacturing in between these episodes, check out The BuildUp. This is a newsletter that we're putting out twice a week. It's got original writing, it's got a lot of our reporting in it. And it's a way to stay informed and keep up to date on all the technology and applications in this space in between.

Peter Zelinski 42:41

Thanks for listening.

Stephanie Hendrixson 42:45

AM Radio is recorded with help from Austin Grogan. The show is edited by Jodee McElfresh and me, Stephanie Hendrixson. Our artwork is by Kate Schrand. AM Radio and Additive Manufacturing Media are products of Gardner Business Media located in the Queen City, Cincinnati, Ohio. I'm Stephanie Hendrixson. Thanks for listening.

Related Content

3D Printed Spares, Electrification and Cool Parts: Top 10 Stories of 2022: AM Radio #31

Our top articles and videos from 2022 reflect increasing use of additive manufacturing for replacement parts; growing applications for electric motors; and a maturing user base. Read through the top 10 list or listen to the AM Radio podcast episode all about these stories.

Read MoreA Framework for Qualifying Additively Manufactured Parts

A framework developed by The Barnes Global Advisors illustrates considerations and steps for qualifying additively manufactured parts, using an example familiar to those in AM: the 3D printed bottle opener.

Read MoreTo Grow Additive Manufacturing Adoption, HP Is Aiming for the C-Suite

3D printing has been largely the purview of service bureaus and technical specialists but HP sees a future where it is increasingly the concern of OEM executives — and the company is taking steps to reach them.

Read More5 Big Themes in Additive Manufacturing at Formnext Forum: Austin

Formnext Forum: Austin, a two-day event at the end of August focused on additive manufacturing for production, includes a conference exploring important ideas in AM related to supply chains, bridge production, enterprise transformation and more.

Read MoreRead Next

Artificial Intelligence and Additive Manufacturing Are Connected: AM Radio #36

Stephanie Hendrixson and Peter Zelinski discuss how AI and AM go together. There are already plenty of uses of AI in 3D printing for design, process planning and process monitoring, and the link will grow stronger as the “frictionlessness” of AI blends with that of AM.

Read MoreUnusual Forms of 3D Printing, and How to Categorize This Technology: AM Radio #21A

In this episode of AM Radio, Stephanie Hendrixson and Peter Zelinski quiz each other on six 3D printing processes — some common, some novel. Test your own knowledge and stick around for a discussion about how to categorize (or maybe re-categorize) AM technologies.

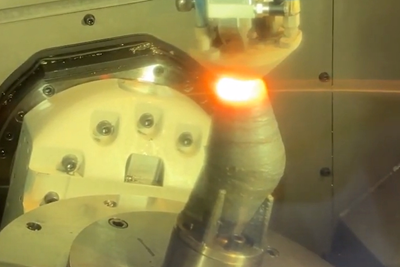

Read MoreHybrid Additive Manufacturing Machine Tools Continue to Make Gains (Includes Video)

The hybrid machine tool is an idea that continues to advance. Two important developments of recent years expand the possibilities for this platform.

Read More