Luck may favor the bold, but in additive manufacturing (AM), work comes to the prepared. Or at least it will, in the markets and industries where AM is finding its production niches and reaching onward to distributed manufacturing. But what does it look like to prepare for this future? How can today’s additive manufacturers set themselves up for success in an increasingly agile production landscape?

At least part of the answer might be found at GKN Additive’s Auburn Hills, Michigan, production site. Formerly Forecast 3D, the additive business was acquired by UK-based GKN Powder Metallurgy (GKN PM) and shares this new space with offices, lab equipment and employees within the PM divisions. But the greater part of the facility’s footprint is already earmarked for Additive, in preparation for the future opportunity the company sees coming. I recently visited the site before most of its AM equipment had been installed, to learn more about GKN PM’s plan for a dramatic expansion in AM capacity.

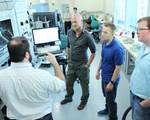

Ken Burns (right) shows me around GKN Additive’s Auburn Hills location in May 2022. Open spaces like this stand ready for more 3D printer installations — capacity that will be needed to support the flexible future of additive production the company sees coming.

GKN Powder Metallurgy has been preparing for its additive future for the last seven-plus years now. With a long history in metallurgy and the production of parts through technologies like press and sinter and metal injection molding (MIM), the company’s first major foray into production additive manufacturing was as a partner for HP’s Metal Jet binder jetting platform. Its technology portfolio now also includes laser powder bed fusion for production of metal parts.

The 2019 acquisition of service bureau Forecast 3D brought polymer 3D printing into the GKN PM portfolio as well. Another HP production partner, Forecast 3D’s Carlsbad, California, facility has one of the largest installations of Multi Jet Fusion (MJF) printers in the world. Over the last three years the two organizations have worked to integrate diverse knowledge bases, cultures and resources into a cohesive additive manufacturing business.

The new Auburn Hills facility is another step toward that integration, with equipment for both polymer and metal additive manufacturing together in the same location, and a focus on part production. Before year’s end, the plan is for this facility to be running a fleet of production-rate polymer and metal additive machines. “This is not for prototyping; this is an agile manufacturing site,” says Ken Burns, vice president. While some R&D will occur here, and the location near Detroit was selected partly to accommodate co-development with automakers, the Auburn Hills facility is destined for production — whether it be in metals or polymers, long-term or short runs.

Preparation as the Foundation to Flexibility

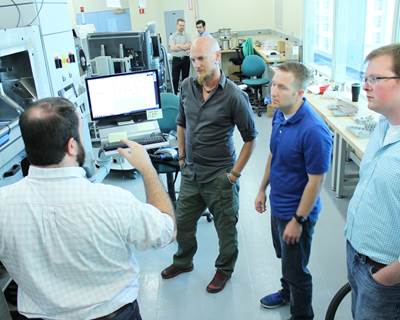

Almost 90% of the additive production happening at Auburn Hills is for automotive. These two EOS M290 laser powder bed fusion (LPBF) machines will soon be joined by a 400M-4 model that will produce the site’s first scale production part for the automotive industry.

Long-term, serial production runs are what GKN PM excels at in its conventional metal parts manufacturing business. When the company first started into additive manufacturing, that kind of sustained production was the goal. Metal 3D printing, and binder jet specifically, were seen as a step in between prototyping and full-scale MIM or press and sinter, and GKN PM anticipated that AM would open new business opportunities at lower, but still significant, levels of ongoing production.

Those opportunities are still on the table, but the company today is pursuing other applications that don’t fit this model. Short-term, fast and flexible jobs are where additive manufacturing is finding its stride. This is true even within the automotive industry; in fact, up to 90% of the parts already being made at Auburn Hills are for these customers. The rising electric vehicle (EV) market is one reason for this high percentage, but the company is finding opportunities in conventional internal combustion vehicles as well, especially where additive can deliver parts quickly and solve supply chain challenges.

Speaking at the 2022 RAPID + TCT event in Detroit, GKN Additive president John Dulchinos told the story of how the company recently used its MJF capacity to produce 60,000 parts needed for the 2022 GM Chevy Tahoe. The SUVs were complete except for a flexible seal component — a late addition needed to improve the car’s fuel economy. Production of this part was delayed by a 12-week lead time on mold tooling, so GKN Additive worked with partners BASF Forward AM and Additive Manufacturing Technologies (AMT) on an alternative. The company ultimately 3D printed the seals from BASF’s Ultrasint TPU01 thermoplastic powder, while AMT provided the vapor smoothing needed for the finish. All told, the full quantity of seals was delivered in just 6 weeks.

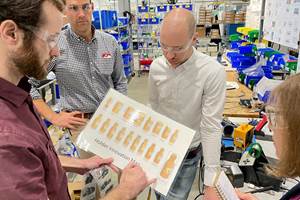

As seen at RAPID: The TPU seals for GM’s 2022 Chevy Tahoe, shown here as-printed (top) and after vapor finishing (bottom).

The seals represent an emergency situation, a bridge production opportunity that came to GKN Additive by chance — but also, through planning. 3D printing was able to deliver the parts in half the time as molding only because the capacity was already available, and because GKN Additive had already taken the time to build a relationship with GM and become one of the automaker’s qualified suppliers. Intentionally pursuing and capturing future production work will mean standing ready in the same way, staying prepared for what may come.

6 Characteristics of AM Readiness

What does that readiness look like? At GKN Additive at least, AM readiness for production has these characteristics:

1. Multiple materials

In this case, GKN PM’s established legacy in powdered metals is complemented by polymer materials developed for the Multi Jet Fusion platform. It might seem odd for a longstanding metals company to adopt production polymer AM, but the primary solutions the company has invested in have the common characteristic that they have been developed for scale. “GKN PM is a pure manufacturing company,” Dulchinos says. “We do scale well.” The systems it is developing to deliver large quantities of 3D printed parts can be applied whether those parts are polymer or metal, opening the door to more opportunities than either material type alone. “Everything in metal wishes it could be polymer,” Dulchinos says, perhaps exaggerating but emphasizing the weight and cost savings that can be realized where printed polymer offers an alternative to machined, cast or formed metal.

Materials must also be available in production-scale quantities; GKN Additive receives its polymer powders from HP in large “octo-bins” like this, because the large container saves time otherwise spent opening many smaller barrels or tubs. As production through additive ramps up, suppliers will need to accommodate the realities of that production in material shipping formats.

2. Multiple platforms

The GKN Additive Auburn Hills site will also be diversified in terms of the types of processes and machines available to apply its materials. On the metals side, the facility is already equipped with several EOS M290 printers for laser powder bed fusion (LPBF) of metals, and will add an EOS M400 to take on a production job for a new GM vehicle. Binder jet capacity in the form of HP’s Metal Jet platform will follow. On the polymer front, the Auburn Hills facility offers both HP Multi Jet Fusion and Carbon Digital Light Processing (DLP) 3D printers.

The Auburn Hills site also has a pair of Carbon M2s for polymer part production, a technology that complements the HP Multi Jet Fusion capacity — sometimes even in the same part. One current production job involves bonding a Carbon print to an MJF part to form an enclosure for a sensor-cleaning mechanism on an autonomous electric vehicle.

3. Located near customers

Proximity to the market reduces shipping and speeds delivery time, but location is also critical in the development of new products. Although GKN Additive’s Carlsbad, California, facility has perhaps the largest fleet of MJF printers in North America, it has been necessary for Auburn Hills to have its own MJF capacity as well. Why? Collaboration with automotive customers is far easier and more expedient in Michigan. The right design can be achieved more quickly when customers have direct access to the manufacturing site, even if the full-scale production might later happen in Carlsbad.

4. Postprocessing and finishing capability

When I visited the facility in May 2022, postprocessing at Auburn Hills was limited to part unpacking, depowdering and cut-off, while other work was being done off-site, often in Carlsbad. The arrangement worked while volumes were low, but to reach scale Auburn Hills needed its own capacity. As Dulchinos puts it “No one wants a printed part. They want a finished part.” Vapor polishing, bead blasting and dyeing have since been added for polymers, and additional machining and heat treat capacity for metals are in the works. Vertically integrating these steps at Auburn Hills again increases the facility’s readiness to deliver not just printed, but finished parts.

Today it’s not uncommon for parts printed in Auburn Hills to be postprocessed in Carlsbad, where equipment and knowledge are already in place. But postprocessing capabilities in Michigan are expanding. Vapor finishing, bead blasting and dyeing have been added for polymers, and heat treat and additional machining capability could soon join this bandsaw as additional capacity for metals.

5. Open machine capacity

In conventional manufacturing processes such as milling, where full-scale quantities might be very high and production is expected to be ongoing, it is not uncommon for a business to purchase a piece of new equipment specifically to serve such a job. In additive manufacturing, however, quantities are lower and the market is less saturated with new, immediately available equipment; it makes less sense to add a new printer that takes months to receive to serve a job that might be completed in 8 weeks.

Instead, the additive manufacturer wishing to take advantage of new opportunities that arise needs to have capacity already available. That may mean that printers sit empty more often, but this risk is necessary in order to have the capacity to take on production jobs as they come. What looks like excess equipment is what makes it possible for GKN Additive to capture fast-turnaround work like the GM SUV seals. “You just have to own the tech before you really know the applications,” Burns says. The organization already operates 36 MJF printers between the Carlsbad and Auburn Hills sites with the capacity to produce hundreds of thousands of parts per week; future expansion will also include adding capacity in Europe.

Capacity right now also looks like the open space behind these two MJF printers. The room dedicated to this process has infrastructure built out to add up to eighteen more. Those machines will likely arrive before there is demand for them, but staying flexible means having capacity in place before opportunities arise.

6. Agility

Both Dulchinos and Burns emphasize the need for GKN Additive to be digital and agile in its operations. AM production does not look or behave like conventional manufacturing; batch sizes are smaller, lead times are shorter, and the variety of parts is greater. This is part of the reasoning behind GKN PM’s acquisition of Forecast3D. “Forecast brings a high-mix mindset,” Dulchinos says, and this fills a gap that high-volume-focused GKN PM previously had. A typical day of jobs at the Carlsbad facility might include everything from a small print job costing just $25 up to a high-volume run priced at $100,000+, and understanding how to cope with this range opens more business opportunities. Scale in additive will come not from producing millions of identical parts, but from producing tens of thousands of different parts, Dulchinos says.

Farther Together

All of these characteristics are laying the groundwork for a future in which GKN Additive can flexibly produce through additive manufacturing — a vision that will also include distributing manufacturing between sites. There are hurdles to clear to make this possible. Beyond equipment and staffing differences, the Michigan facility is unlike the California one in ways related to geography and climate, including fluctuations in temperature and humidity that can directly affect the behavior of material and machines. Certifications and permissions add another layer of complexity; the Carlsbad facility is ITAR-certified, which allows it to take on sensitive work, but pursuing ITAR for Auburn Hills would lock down the operation in a way that would make close collaboration with automotive customers more difficult. Rather than perfectly duplicating its operations, GKN Additive is coming to think of distributed manufacturing as distributed capability; not every facility will be able to handle every job, but where manufacturing can be dispersed, agility can extend to a greater scale.

“We want to send parts where it makes sense, not just where the open capacity is,” Burns says.

This new facility adds another option for where certain parts make sense, supporting greater flexibility in AM production. Meanwhile, Forecast 3D’s comfort in variety paired with GKN PM’s discipline and legacy will allow this new GKN Additive enterprise to go farther than either company might have alone.

Related Content

Plastics Assembly Expert Joins Development and Production via 3D Printing

Manufacturing technology supplier Extol has always served customers who are producing polymer parts. Now, it is making some of those parts in-house through 3D printing, providing new options ranging from functional prototyping into bridge production and beyond.

Read More3D Printed Spares, Electrification and Cool Parts: Top 10 Stories of 2022: AM Radio #31

Our top articles and videos from 2022 reflect increasing use of additive manufacturing for replacement parts; growing applications for electric motors; and a maturing user base. Read through the top 10 list or listen to the AM Radio podcast episode all about these stories.

Read MoreHow Additive Manufacturing Is Transforming EVs and Transportation: AM Radio #23

As 3D printing is adopted into the electric vehicle (EV) market, it is not just vehicles that are being reshaped. In this episode of the AM Radio podcast, we discuss additive manufacturing and the future of transportation.

Read More8 Transformations 3D Printing Is Making Possible

Additive manufacturing changes every space it touches; progress can be tracked by looking for moments of transformation. Here are 8 places where 3D printing is enabling transformative change.

Read MoreRead Next

GKN's Acquisition of Forecast 3D Points the Way to AM's Future

The vision? Parts produced on demand where they are needed, from the material that makes sense.

Read More4 Ways the Education and Training Challenge Is Different for Additive Manufacturing

The advance of additive manufacturing means we need more professionals educated in AM technology.

Read MoreAt General Atomics, Do Unmanned Aerial Systems Reveal the Future of Aircraft Manufacturing?

The maker of the Predator and SkyGuardian remote aircraft can implement additive manufacturing more rapidly and widely than the makers of other types of planes. The role of 3D printing in current and future UAS components hints at how far AM can go to save cost and time in aircraft production and design.

Read More

.jpg;width=70;height=70;mode=crop)