Investment Trends in Additive Manufacturing: Shifting Focus

Application investments flourish while next-generation technology developers take on the future.

The additive manufacturing (AM) industry experienced the same screeching halt felt by the rest of the world in 2020, only to accelerate to a 2021 high and straight into increasing uncertainty in 2022. Despite this uncertainty and recessionary expectations in the United States, AM continues to show outsized financing activity given the industry’s relatively modest market size —often quoted to be between $15 billion and $20 billion globally. Tracking this emerging manufacturing technology category begins with an analysis of these financial leading indicators.

In high-growth technologies or industries, financial investments are typically announced publicly and often include dollar amounts. When taken in aggregate, these announcements reflect the collective entrepreneurial activity of the sector and the interest levels from financial and corporate strategic investors. Reviewing that data and trends in the face of 2022 headwinds shows the beginnings of a striking shift in focus for investors and acquirers.

Investments in AM are grouped into four categories based on technology and positions across the value chain: materials, core, software and applications. Materials investments cover material suppliers, formulators and developers. Core investments represent AM processes, 3D printers and postprocessing equipment developers alongside 3D printing service providers, online marketplaces and other hardware technology enablers. The software category represents companies with a specialization in AM software across any part of the computer-aided design, engineering or manufacturing workflow. Applications companies include specialized service companies focused on a particular industry or product class, such as dental appliances, automotive or antennas. (Note: All investment data excludes biological, construction, food and desktop consumer-focused 3D printing companies.)

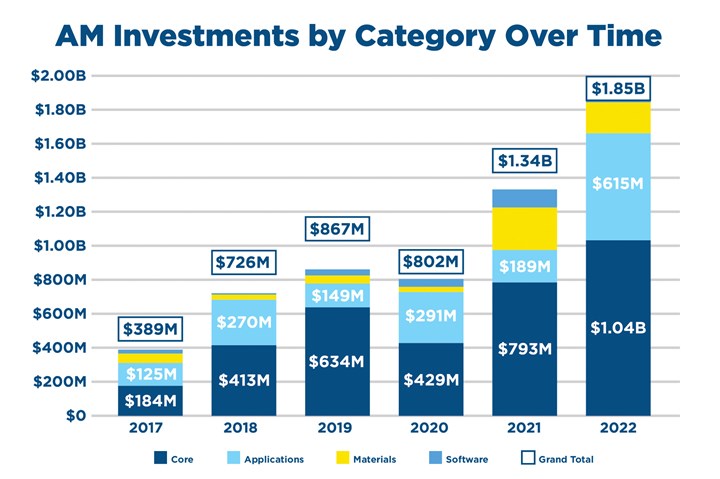

Global venture capital investment in AM companies has grown 36.7% annually from $389 million in 2017 to $1.853 billion in 2022. The incredible momentum gained in 2021 continued well into 2022 with an additional $514 million in funding. Disproportionate gains relative to 2021 were centered on applications and core categories with $1.039 billion and $615 million invested, respectively.

AMT – The Association For Manufacturing Technology identified five outlier transactions that together make up $707 million split between dental applications and core categories. While uncharacteristically large minority investments are not uncommon, the applications category received 3.3 times more investment than in 2021, becoming the second largest category (after core) in 2022, with 21 transactions. Such a strong showing for applications across dental, medical, aerospace, consumer and automotive suggests that investors are finally looking toward specialization and focused product-market fit opportunities.

Hardware manufacturers have increasingly reflected this in product offerings that target specific applications, a subtle change to the industry standard, where one printer model serves all applications in a size range. Investments into core technologies and services remains as high as ever with 38 transactions and a continued focus on better, faster and/or less expensive AM hardware.

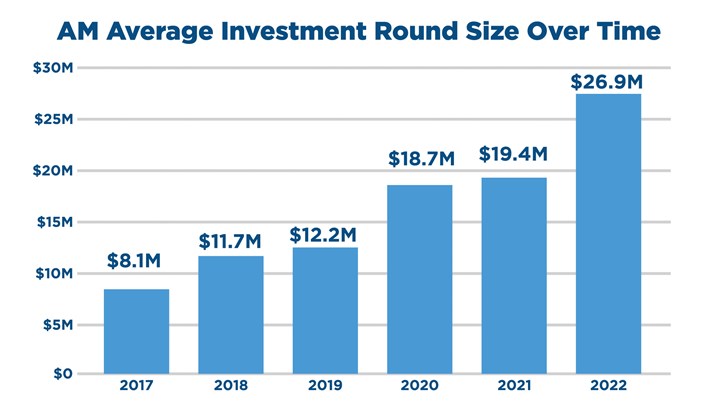

Average investment size increased to a new high of $26.9 million for 2022, up nearly 40% — due in part to large investments in a small number of companies, including Vulcan Forms, Divergent, Fictiv, Prismlab and SprintRay. The larger average additionally indicates an increased number of later-stage funding rounds relative to past years. While this is a positive sign for companies with significant market traction already, the middle funding tiers continue to be underserved by investors, which creates tighter conditions for companies looking to scale up proven technologies.

Investments by Region

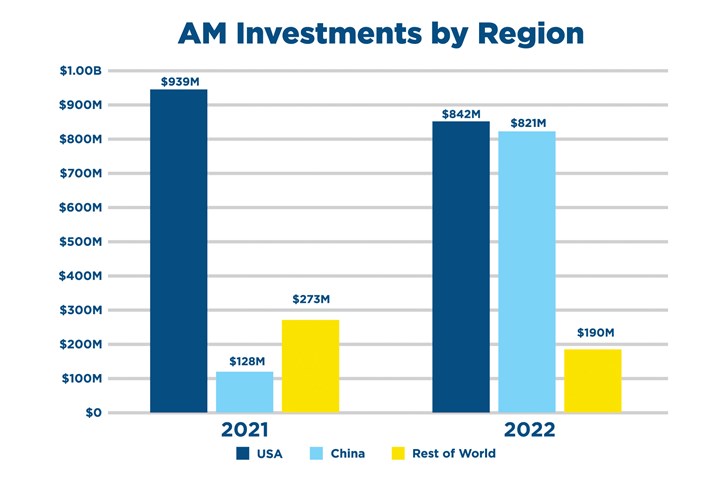

The COVID-19 pandemic’s lingering effects continue to be observed in global supply chains, slowing the flow of materials and goods across industries throughout 2022. Disrupted supply chains trigger hesitation and uncertainty among investors already looking to recessionary concerns on the horizon.

Investors looking or needing to act are considering high-growth industries such as advanced manufacturing, which serve as a hedge against supply chain uncertainty. Geopolitical tensions add to the uncertainty of deploying capital in long-term international opportunities, pushing some investors with dry powder toward startup opportunities closer to home.

This effect was amplified in China, where “zero-COVID” policies continued in 2022 with significant lockdowns and labor shortages. Looking at the 3D printing investment landscape, just three companies received $379 million in venture capital funding for 3D printed dental applications such as customized clear aligners. Another $79 million went to a company developing laser powder bed fusion 3D printers intent on serving aerospace, marine and automotive customers. These four transactions alone pushed the total investment in Chinese 3D printing companies six times higher in 2022 than in 2021.

Around the world, significant late-stage investments such as these may become more frequent as global supply chains search for ways to become more resilient through AM’s flexibility. In October, the Chinese government released an updated list of approved sectors for foreign investment, including 39 new sectors with a heavy focus on advanced manufacturing. At the same time, the U.S. government has made significant commitments to invest in critical manufacturing and technology areas.

The next few years will undoubtedly include more outsized investments in core technology developers, service providers and applications. Combining a strong investment year and a view toward mitigating supply chain uncertainty will undoubtedly accelerate the technology’s development and further adoption in domestic markets. With investor interest shifting to applications as a notable complement to core technology companies, advanced manufacturing may more efficiently find product-market fit and ultimately find more paths to deliver on its promises.

For questions or comments, please email dhorvath@AMTonline.org.

This article was written by Dayton Horvath, AMT director – emerging technology & investments, with analysis and contributions from AMT analysts Mark Huber and Camren Sonneveldt.

Read Next

At General Atomics, Do Unmanned Aerial Systems Reveal the Future of Aircraft Manufacturing?

The maker of the Predator and SkyGuardian remote aircraft can implement additive manufacturing more rapidly and widely than the makers of other types of planes. The role of 3D printing in current and future UAS components hints at how far AM can go to save cost and time in aircraft production and design.

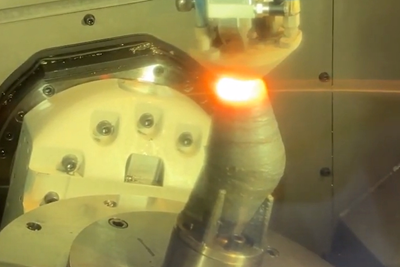

Read MoreHybrid Additive Manufacturing Machine Tools Continue to Make Gains (Includes Video)

The hybrid machine tool is an idea that continues to advance. Two important developments of recent years expand the possibilities for this platform.

Read More3D Printing Brings Sustainability, Accessibility to Glass Manufacturing

Australian startup Maple Glass Printing has developed a process for extruding glass into artwork, lab implements and architectural elements. Along the way, the company has also found more efficient ways of recycling this material.

Read More

.png;maxWidth=300;quality=90)