Economies of Scope: Additive Manufacturing’s Trajectory Toward Bigness

A new book argues that the advance of AM will ultimately favor bigger and bigger manufacturers. Recent articles about groups and companies seeking to benefit from AM show a tiny trajectory in the same direction.

Share

Read Next

Additive manufacturing (AM) enables new options in part geometry, including internal complex passages and topology-optimized forms. We’ve covered this. We have also covered the way AM is making possible new options in materials.

Now, it is time to begin considering how AM will change the shape of manufacturing organizations, a theme of our recent coverage. Articles we’ve posted describe a regional association, supplier collaboration and a new business model all built around AM. In each of these cases, people are organizing themselves in a new or different way to better advance or leverage additive.

Could it be that these various groups and companies are all onto something?

Dartmouth College business professor Richard D’Aveni, in his new book, The Pan-Industrial Revolution, takes a long view on additive manufacturing to speculate on the very different type of manufacturing company likely to result from the maturing of this technology. His central insight: Additive manufacturing wants to be big. That is, AM’s use will favor bigger and bigger manufacturers—albeit big in a way we have not seen before. Whereas manufacturers in the past thrived on economies of scale (redundant parts, high volumes) additive manufacturers will thrive on something different: economies of scope. By using their AM resources to serve an ever-broader mix of industries, additive manufacturers will become big by means of this breadth. In fact, D’Aveni argues they’ll become huge.

Why does additive favor bigness, and bigness by breadth? Here are some of the reasons I find most compelling:

1. Lack of dedicated resources. Traditional manufacturers tend to serve certain industry sectors because they have equipment or knowledge suited to that sector—types of machinery, expertise or tooling acquired for the work in that field. AM is not characterized by this kind of dedication. Two sets of parts for two very different industries can be made on the same machine and maybe even in the same build.

2. Consolidation of operations. Another obstacle to serving various industries is that the supply chains tend to be different. But because of the way AM generates a nearly complete, complex part that might consolidate what used to require different organizations for casting, machining and assembly, the length and impact of supply chains is significantly reduced. As a result, with additive, there is far less bureaucracy cost for serving many sectors.

3. Material savings. An AM operation able to get dramatically bigger would get more cost-effective as a result, because of the advantage it could command in material pricing. For this reason, D’Aveni sees manufacturers coming to specialize by material rather than by industry. Imagine a company with a dispersed array of plants full of additive machines that all run the same metal alloy. For work requiring this specific metal, this firm’s buying power could give it a raw material cost lower than that of any competitor.

4. Machine learning. Another powerful effect: Big scope equals big data. We have covered the way AM is distinctively poised to benefit from the application of machine learning. In a company marshaling more additive machines to serve more industries, machine learning algorithms aimed at making processes more efficient will have more data to work with and therefore will be more effective at improving efficiency. Bigness will produce better artificial intelligence for directing the company’s processes.

D’Aveni’s book goes farther than this, speculating on the nature of a world where production is dominated by massive pan-industrial additive manufacturing titans. We are still far from that world. But I am struck by the tiny trajectory already noticeable in the articles in this issue. While the stories are different, the solution in each case is roughly the same: The way to advance AM is to gather together.

Related Content

New Electric Dirt Bike Is Designed for Molding, but Produced Through 3D Printing (Includes Video)

Cobra Moto’s new all-electric youth motocross bike could not wait for mold tooling. Parts have been designed so they can be molded eventually, but to get the bike to market, the production method now is additive manufacturing.

Read MoreWhat Does Additive Manufacturing Readiness Look Like?

The promise of distributed manufacturing is alluring, but to get there AM first needs to master scale production. GKN Additive’s Michigan facility illustrates what the journey might look like.

Read More3D Printing with Plastic Pellets – What You Need to Know

A few 3D printers today are capable of working directly with resin pellets for feedstock. That brings extreme flexibility in material options, but also requires greater knowledge of how to best process any given resin. Here’s how FGF machine maker JuggerBot 3D addresses both the printing technology and the process know-how.

Read MoreVulcanForms Is Forging a New Model for Large-Scale Production (and It's More Than 3D Printing)

The MIT spinout leverages proprietary high-power laser powder bed fusion alongside machining in the context of digitized, cost-effective and “maniacally focused” production.

Read MoreRead Next

At General Atomics, Do Unmanned Aerial Systems Reveal the Future of Aircraft Manufacturing?

The maker of the Predator and SkyGuardian remote aircraft can implement additive manufacturing more rapidly and widely than the makers of other types of planes. The role of 3D printing in current and future UAS components hints at how far AM can go to save cost and time in aircraft production and design.

Read More3D Printing Brings Sustainability, Accessibility to Glass Manufacturing

Australian startup Maple Glass Printing has developed a process for extruding glass into artwork, lab implements and architectural elements. Along the way, the company has also found more efficient ways of recycling this material.

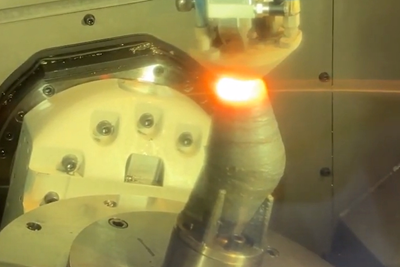

Read MoreHybrid Additive Manufacturing Machine Tools Continue to Make Gains (Includes Video)

The hybrid machine tool is an idea that continues to advance. Two important developments of recent years expand the possibilities for this platform.

Read More