Arcam CEO Speaks of Promise and Progress in Aerospace and Orthopedic Industries

Growth is expected as both industries transition more production components to AM.

Share

Read Next

At Arcam’s Investor Day last week, the company welcomed investors in the NASDAQ-listed firm to the company’s new U.S. headquarters in Woburn, Massachusetts (near Boston). President and CEO Magnus René, who spoke at length at the event, recently relocated from the company’s home in Sweden to be based at this new office. The reason for his move, he told the group, is because the United States is the company’s “biggest market and biggest opportunity.”

The move also brings him nearer to Arcam’s two acquired business units, both based in North America. AP&C in Quebec supplies powder metal for additive manufacturing. DiSanto Technology in Connecticut provides contract manufacturing services including both additive manufacturing (on Arcam machines) and CNC machining. Meanwhile, parent company Arcam makes AM systems building 3D metal parts through electron beam melting, or EBM. René says Arcam is therefore the only company to combine all of these different facets of metal AM under a single corporate ownership.

The chief market sectors for the company are orthopedic implants and aerospace components. These two product types have important traits that make them ideal for additive, he told investors. Both are characterized by high material costs and low production volumes, and both stand to benefit significantly from the expanded design freedom that AM provides. His message to the audience was that there is dramatic potential for the growth of AM in both of these sectors. Indeed, he says, the adoption of AM is at only the very earliest stages in both industries.

In orthopedics, Arcam’s point of entry has been improved part performance through design freedom. Specifically, implant surface geometries formed through AM provide for superior fusing with the patient’s bone compared to traditional implant surfaces created through spray technology. Additive implants have been adopted and are in use today for this reason. Building on this success, René expects AM to be adopted next for the production of “outlier” implant part numbers made in such low volumes as to be awkward to produce through conventional manufacturing. From there, he expects the implant makers to bring this same approach to manufacturing more standard parts, applying AM in many cases to eliminate the need for forging and dramatically reduce the need for machining.

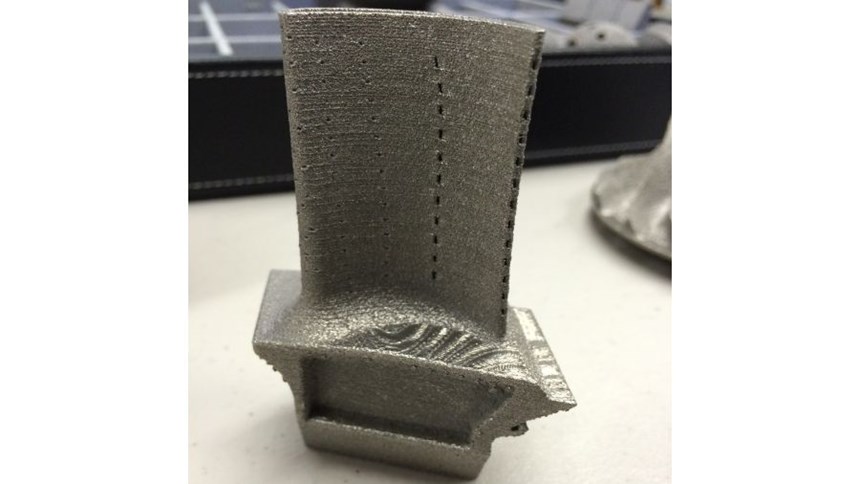

By contrast, in aerospace, he says the point of entry has been essentially at the opposite end of this progression. The initial uses of AM for aerospace parts have served primarily to replace standard processes in the production of parts that are particularly difficult to make. Examples of this are still coming—a titanium aluminide aircraft turbine blade made from EBM as a replacement for casting will go into production in 2018. Later, he says, aerospace companies will build on successes such as this with existing part designs by leveraging AM’s design freedoms to realize new parts that offer improved performance.

But even the volume of existing parts presents important challenges. Just the aforementioned blade—a single part number for a single aircraft engine maker—will require 30 to 40 EBM machines to satisfy the eventual production demand. René says this illustrates why the next step for Arcam will have to be a further “industrialization” of both the company and its technology. That is, the company will have to prepare to meet the demand as additive-manufactured parts increasingly move beyond development and into full production.

Related Content

Aluminum Gets Its Own Additive Manufacturing Process

Alloy Enterprises’ selective diffusion bonding process is specifically designed for high throughput production of aluminum parts, enabling additive manufacturing to compete with casting.

Read More10 Important Developments in Additive Manufacturing Seen at Formnext 2022 (Includes Video)

The leading trade show dedicated to the advance of industrial 3D printing returned to the scale and energy not seen since before the pandemic. More ceramics, fewer supports structures and finding opportunities in wavelengths — these are just some of the AM advances notable at the show this year.

Read MoreAdditive Manufacturing Is Subtractive, Too: How CNC Machining Integrates With AM (Includes Video)

For Keselowski Advanced Manufacturing, succeeding with laser powder bed fusion as a production process means developing a machine shop that is responsive to, and moves at the pacing of, metal 3D printing.

Read MoreMultimaterial 3D Printing Enables Solid State Batteries

By combining different 3D printing processes and materials in a single layer, Sakuu’s Kavian platform can produce batteries for electric vehicles and other applications with twice the energy density and greater safety than traditional lithium-ion solutions.

Read MoreRead Next

4 Ways the Education and Training Challenge Is Different for Additive Manufacturing

The advance of additive manufacturing means we need more professionals educated in AM technology.

Read More3D Printing Brings Sustainability, Accessibility to Glass Manufacturing

Australian startup Maple Glass Printing has developed a process for extruding glass into artwork, lab implements and architectural elements. Along the way, the company has also found more efficient ways of recycling this material.

Read MoreAt General Atomics, Do Unmanned Aerial Systems Reveal the Future of Aircraft Manufacturing?

The maker of the Predator and SkyGuardian remote aircraft can implement additive manufacturing more rapidly and widely than the makers of other types of planes. The role of 3D printing in current and future UAS components hints at how far AM can go to save cost and time in aircraft production and design.

Read More

.jpg;width=70;height=70;mode=crop)