HP Partners with Deloitte to Bring Additive Manufacturing to the Enterprise Level

HP’s Multi Jet Fusion process is being used as a production technology today, but now the company has its sights set on enterprise-level (and industry-wide) disruption enabled by partnerships and spanning the entire supply chain.

HP’s decision to become a supplier of 3D printing equipment was not just a move to capture a portion of the existing additive manufacturing market. Instead, the company has its sights set on something much bigger: “to disrupt the $12 trillion manufacturing industry” at large, according to Dion Weisler, president and CEO. 3D printing technology has advanced to the point that this is possible, he argues, but the challenge remaining is how to deploy that technology on a global level.

HP has seen this disruption as the end goal since releasing its Multi Jet Fusion (MJF) 3D printing technology in 2016. And that's one of the reasons for its recently announced partnership with Deloitte, an expert in digital supply chain transformations. According to a statement from the two companies, the alliance will help enterprises accelerate product design and production, create more flexible manufacturing and supply chains, and optimize efficiency across the manufacturing lifecycle.

The partnership was formally announced during an event titled "Reinventing Manufacturing" held at HP's Palo Alto facility. I joined a group of fellow journalists on a series of tours and sessions to learn more about HP's technology and what this alliance could mean for the manufacturing industry at large.

From 2D to 3D

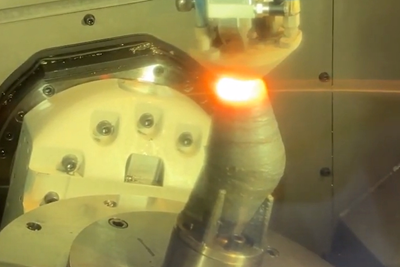

HP and Deloitte see 3D printing as the enabling technology for "reinventing" manufacturing, specifically HP’s Multi Jet Fusion (MJF) technology. MJF is a powder-bed-based process that actually has more in common with inkjet printing than with point-by-point laser-based powder fusion systems. The design of the system draws on HP’s expertise in microfluidics and the precise deposition of inks; in fact, the MJF printers feature a printhead similar to that used inside the company’s digital presses.

The MJF printhead deposits droplets of binding and detailing agents across layers of polymer powder within a preheated bed. The process is similar to binder-jetting, but rather than sintering the part all at once in a separate step, MJF fuses each layer after the agents are deposited.

The binder serves as a heat-absorbing ink, making the powder it binds more prone to melting. The printer’s preheated bed and overhead lamps keep the powder warm, and when infrared energy from a fusion lamp is added, the powder affected by the binder reaches its melting point and fuses solid. Meanwhile, a detailing agent enables a cooling effect, providing crisp edges around the melted area and preventing the meltpool from bleeding into the loose powder.

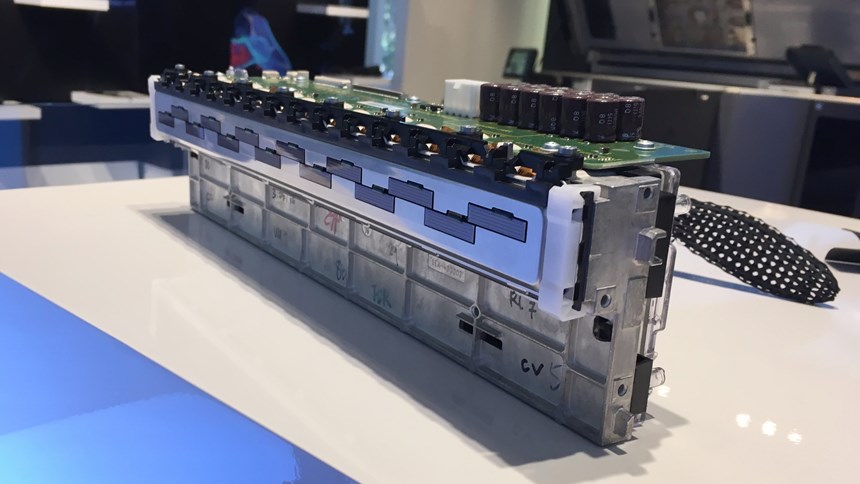

HP currently offers two models of its Jet Fusion 3D printer, the 3200 and 4200 models, which differ in their build speeds and layer thicknesses. The printer is just one part of the MJF system, however. A portable, exchangeable build unit containing the polymer powder is installed in the printer before the build, and removed (carrying the completed parts with it) after the print to a separate postprocessing station for cooling and powder removal. A single printer can run almost continuously by swapping out the build units as each print is complete, and used powder can be recycled directly by loading it back into a build unit from the postprocessing station.

“If you were to make less than 55,000 gear cogs, it would be cheaper and much more economical to 3D print them than it would be to injection mold them.”

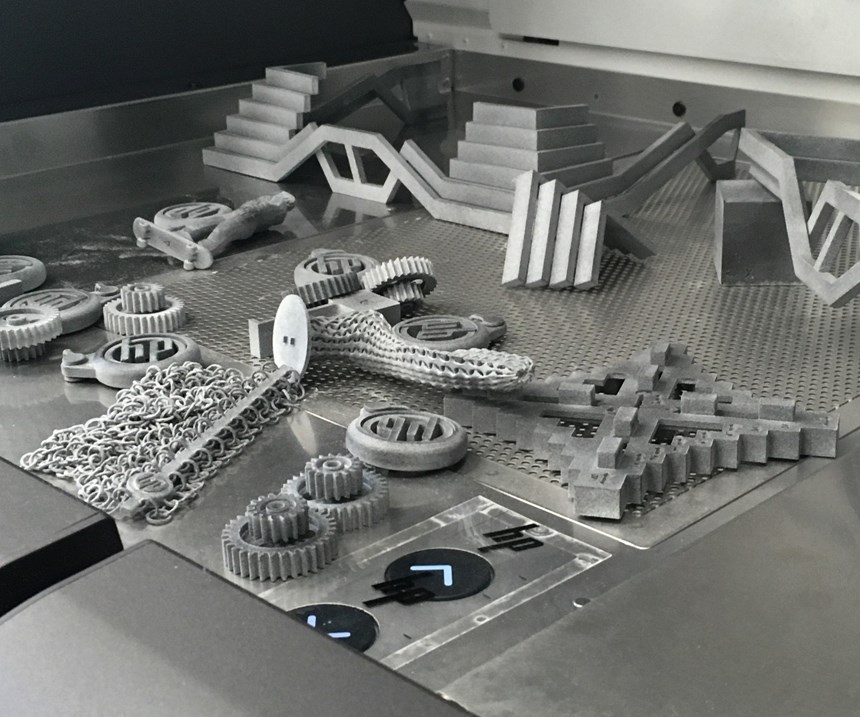

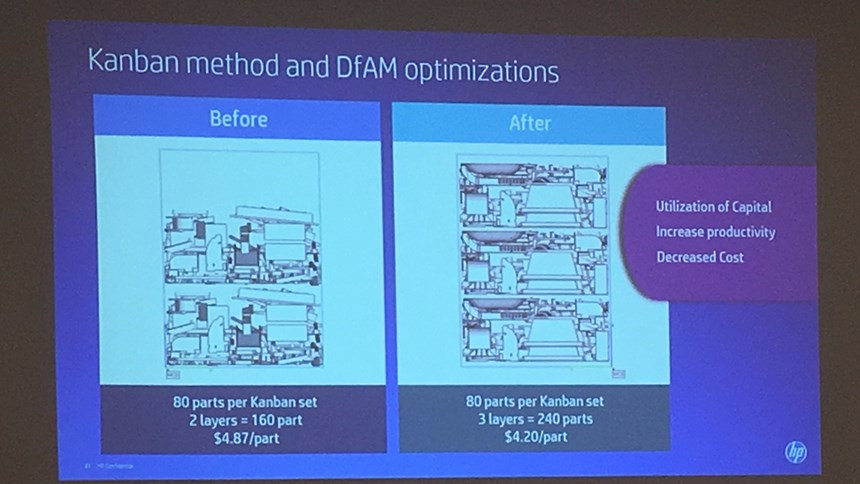

The keys to the MJF process are its speed, part quality and efficiency. According to David Tucker, market development manager for 3D printing at HP Inc., area-based melting allows for faster printing, while the mechanics of the printhead and its shuttle enable XY accuracy of 1,200 dpi. Parts are about 80 percent isotropic as a result of holding the temperature of the material at its melting point for longer than other processes, Tucker says. Reduced warping and the lack of need for support structures also provides the ability to nest and stack parts. Individual parts can be placed as little as 3 mm apart and printed simultaneously without extending the print time, enabling a Kanban approach to manufacturing.

This combination of qualities is what makes MJF a viable alternative to other production technologies such as injection molding, according to HP. One example Weisler gave during a Q&A with the press was a gear cog. The speed of MJF extends the viable quantities for 3D printing this part well into the tens of thousands.

“If you were to make less than 55,000 gear cogs, it would be cheaper and much more economical to 3D print them than it would be to injection mold them,” he explains. To manufacture more than that quantity, it would still make sense to mold them today. With advances in material science, costs for materials coming down and increased machine productivity, HP expects the inflection point where 3D printing makes sense will shift upward even further.

An “Enterprise-Class Approach”

But it's no longer enough to talk about 3D printing technology in isolation. To change the broader manufacturing industry as HP envisions requires an entirely different approach to the supply chain as a whole.

"The farther back you employ AM, the more value you obtain," Tucker says, speaking about the need to involve additive manufacturing as early as possible in a product’s lifecycle to take full advantage of its capabilities. There are economic advantages to using 3D printing as a prototyping tool; however, more value is gained by optimizing designs to be manufactured via 3D printing and taking advantage of its capacity to combine assemblies into a single part, for instance.

But the greatest value of all is realized by creating products and services that are only possible through additive manufacturing, Tucker says. This means more than leveraging AM’s capability to create organic features or optimized geometries; it means taking advantage of the digitization of AM to enable custom, localized and on-demand manufacturing.

That’s not necessarily something that today’s manufacturers—even large, global suppliers—are ready to implement. That’s where HP’s alliance with Deloitte will come into play.

In a virtual press briefing, Scott Schiller, global head of customer and market developing for HP’s 3D printing business, called the arrangement an “enterprise-class approach” to accelerate 3D printing within the manufacturing industry. Deloitte’s role will be to work jointly with customers to help them change business processes and strategies. Other solutions providers will also be involved in the effort, including Siemens, a developer of CAD and PLM software, and SAP, a provider of ERP systems.

Ultimately, the goal is to work toward the digitization of manufacturing. Together these partners will provide assessment and end-to-end solutions designed to help businesses make this transition. That digitization might mean everything from generatively designing components based on engineering performance data to manufacturing parts on demand in local markets to storing files rather than inventory—all promises that 3D printing technology is uniquely positioned to deliver.

Related Content

How Large-Format 3D Printing Supports Micro-Scale Hydropower

There is potential hydroelectric power that has never been unlocked because of the difficulty in capturing it. At Cadens, additive manufacturing is the key to customizing micro-scale water turbine systems to generate electricity from smaller dams and waterways.

Read MoreAM 101: Digital Light Synthesis (DLS)

Digital Light Synthesis (DLS) is the name for Carbon's resin-based 3D printing process. How it works and how it differs from stereolithography.

Read MoreSolving 3D Printing’s Hidden Problem: Vibration

Ulendo’s vibration compensation software can double the speed of FFF 3D printers while maintaining part quality, all without changing the machine’s hardware.

Read MorePossibilities From Electroplating 3D Printed Plastic Parts

Adding layers of nickel or copper to 3D printed polymer can impart desired properties such as electrical conductivity, EMI shielding, abrasion resistance and improved strength — approaching and even exceeding 3D printed metal, according to RePliForm.

Read MoreRead Next

Overcoming Obstacles to Bring AM into the Supply Chain

A conversation with Jabil’s John Dulchinos and HP’s Stephen Nigro illustrates some of the challenges in integrating additive manufacturing into a supply chain for production parts.

Read More4 Ways the Education and Training Challenge Is Different for Additive Manufacturing

The advance of additive manufacturing means we need more professionals educated in AM technology.

Read MoreHybrid Additive Manufacturing Machine Tools Continue to Make Gains (Includes Video)

The hybrid machine tool is an idea that continues to advance. Two important developments of recent years expand the possibilities for this platform.

Read More

.jpg;width=70;height=70;mode=crop)